| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | idrees |

Company B is an all equity financed company with a cost of equity of 10%.

It is considering issuing bonds in order to achieve a gearing level of 20% debt and 80% equity.

These bonds will pay a coupon rate of 5% and have an interest yield of 6%.

Company B pays corporate tax at the rate of 25%.

According to Modigliani and Miller's theory of capital structure with tax, what will be Company B's new cost of equity?

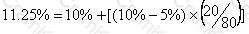

A)

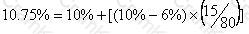

B)

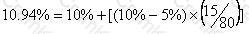

C)

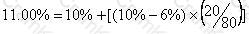

D)

Option A

Option B

Option C

Option D

An all equity financed company reported earnings for the year ending 31 December 20X1 of $8 million.

One of its financial objectives is to increase earnings by 5% each year.

In the year ending 31 December 20X2 it financed a project by issuing a bond with a $1 million nominal value and a coupon rate of 4%.

The company pays corporate income tax at 20%.

If the company is to achieve its earnings target for the year ending 31 December 20X2, what is the minimum operating profit (profit before interest and tax) that it must achieve?

Company A is a large listed company, with a wide range of both institutional and private shareholders.

It is planning a takeover offer for Company B.

Company A has relatively low cash reserves and its gearing ratio of 40% is higher than most similar companies in its industry.

Which TWO of the following would be the most feasible ways of Company A structuring an offer for Company B?

Which of the following statements about the tax impact on debt finance is correct?