| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | maddie |

Z wishes to borrow at a floating rate and has been told that it can use swaps to reduce the effective interest rate it pays. Z can borrow floating at Libor ' 1, and fixed at 10%.

Which of the following companies would be the most appropriate for Z to enter into a swap with?

DFG is a successful company and its shares are listed on a recognised stock exchange. The company's gearing ratio is currently in line with the industry average and the directors of DFG do not want to increase the company's financial risk. The company does not carry a large cash balance and its shareholders are not expected to be willing to support a rights issue at this time

LMB is a small services company owned and managed by a small board of directors who are going to retire within the next year

DFG wishes to purchase LMB and has approached LMB's owners, who are broadly open to the proposal, to discuss the bid and the consideration to be offered by DFG. LMB's owners explain to DFG that they are also keen to defer any tax liabilities they would be subject to on receipt of the consideration.

Based on the information provided, which of the following types of consideration would be most suitable to finance the acquisition?

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

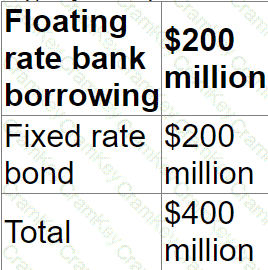

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

X exports goods to customers in a number of small countries Asia. At present, X invoices customers in X's home currency.

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?