| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | liya |

A wholly equity financed company has the following objectives:

1. Increase in profit before interest and tax by at least 10% per year.

2. Maintain a dividend payout ratio of 40% of earnings per year.

Relevant data:

• There are 2 million shares in issue.

• Profit before interest and tax in the last financial year was $4 million.

• The corporate income tax rate is 20%.

At the beginning of the current financial year, the company raised long term debt of $2 million at 5% interest each year.

Calculate the dividend per share that will be announced this year assuming the company achieves its objective of increasing profit before interest and tax by 10%.

An unlisted software development company has recently reported disappointing results. This was partly due to weak economic conditions but also because of its poor competitive position. The company has a number of exciting development opportunities which would enable it to achieve significant future growth. The company's growth potential has been hindered by its inability to secure sufficient new finance.

To enable the company raise new finance the Directors are considering working forwards an IPO in 10 years and accepting finance from a venture capitalist in order support in the intervening period.

The directors are keen to retain a controlling stake in the company and full representation on the board. They therefore require venture capitalists to provide funds as a mix of debt and equity and not soley equity finance.

Which THREE of the following are most likely to disrupt the directors' plans to use venture capital finance?

A company has 8% convertible bonds in issue. The bonds are convertible in 3 years time at a ratio of 20 ordinary shares per $100 nominal value bond.

Each share:

• has a current market value of $5.60

• is expected to grow at 5% each year

What is the expected conversion value of each $100 nominal value bond in 3 years' time?

Company Z has identified four potential acquisition targets: companies A, B, C and D.

Company Z has a current equity market value of $590 million.

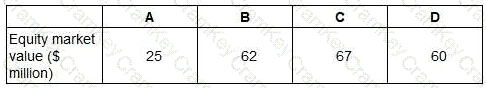

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

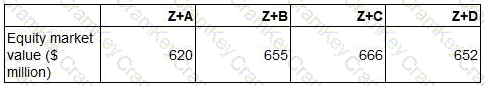

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?