| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | sylvie |

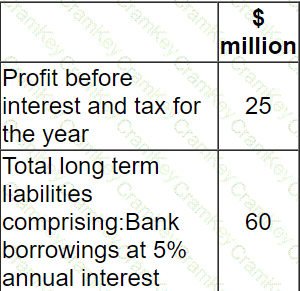

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

Company ADE is an unlisted company; it needs to raise a significant amount of finance to fund future expansion. The directors are considering listing the company on the local stock exchange The following discussions have taken place between some of the directors:

Director A - We consider a public issue of bonds in the capital markets, we don't need to list to issue the bonds which will save time and money.

Director B - We should list on the Alternative Investment Market (AIM) and not the main market to avoid any regulatory requirements

Director C - We should remain unlisted; we can access an unlimited amount of equity finance through a rights issue

Director D - Listing will increase Company ADE's ability to raise new equity and debt finance in the future.

Director E - If we list, Company ADE will be a more likely target for a takeover than if we remain unlisted.

Which TWO of the directors' statements are correct?

Company A is a listed company that produces pottery goods which it sells throughout Europe. The pottery is then delivered to a network of self employed artists who are contracted to paint the pottery in their own homes. Finished goods are distributed by network of sales agents.The directors of Company A are now considering acquiring one or more smaller companies by means of vertical integration to improve profit margins.

Advise the Board of Company A which of the following acquisitions is most likely to achieve the stated aim of vertical integration?

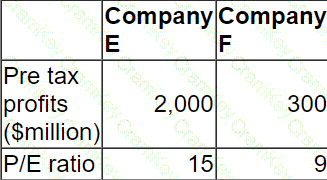

Company E is a listed company. Its directors are valuing a smaller listed company, Company F, as a possible acquisition.

The two companies operate in the same markets and have the same business risk.

Relevant data on the two companies is as follows:

Both companies are wholly equity financed and both pay corporate tax at 30%.

The directors of Company E believe they can "bootstrap" Company F's earnings to improve performance.

Calculate the maximum price that Company E should offer to Company F's shareholders to acquire the company.

Give your answer to the nearest $million.