| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | giovanni |

A company has a financial objective of maintaining a gearing ratio of between 30% and 40%, where gearing is defined as debt/equity at market values.

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

• Share capital of 4 million $1 shares trading at $4.0 per share.

• Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?

Company R is a major food retailer. It wishes to acquire Company S, a food manufacturer.

Company S currently supplies many stores owned by Company R with food products that it manufactures.

Company S is of similar size to Company R but has a lower credit rating.

Which of the following is most likely to be a synergistic benefit to R on purchasing S?

A company has in a 5% corporate bond in issue on which there are two loan covenants.

• Interest cover must not fall below 3 times

• Retained earnings for the year must not fall below $3.5 million

The Company has 200 million shares in issue.

The most recent dividend per share was $0.04.

The Company intends increasing dividends by 10% next year.

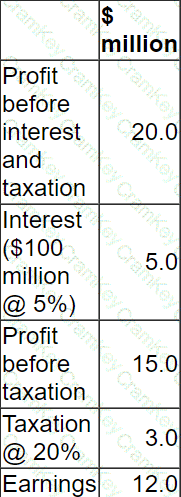

Financial projections for next year are as follows:

Advise the Board of Directors which of the following will be the status of compliance with the loan covenants next year?

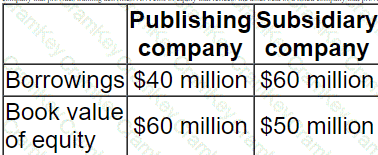

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?