| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | nala |

Company WWW is identical in all operating and risk characteristics to Company ZZZ. but their capital structures differ. Company WWW and Company ZZZ both pay corporate income tax at 20%

Company WWW has a gearing ratio (debt: equity) of 1:3 Its pre-tax cost of debt is 6%.

Company ZZZ Is all-equity financed. Its cost of equity is 15%

What is the cost of equity tor Company WWW?

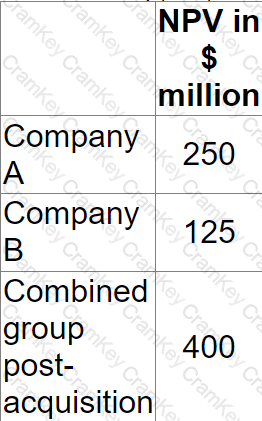

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A’s accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

A private company was formed five years ago and is currently owned and managed by its five founders. The founders, who each own the same number of shares have generally co-operated effectively but there have also been a number of areas where they have disagreed

The company has grown significantly over this period by re-investing its earnings into new investments which have produced excellent returns

The founders are now considering an Initial Public Offering by listing 70% of the shares on the local stock exchange

Which THREE of the following statements about the advantages of a listing are valid?

A new company was set up two years ago using the personal financial resources of the founders.

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?