| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | anabia |

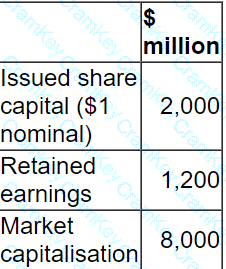

A listed company is financed by debt and equity.

If it increases the proportion of debt in its capital structure it would be in danger of breaching a debt covenant imposed by one of its lenders.

The following data is relevant:

The company now requires $800 million additional funding for a major expansion programme.

Which of the following is the most appropriate as a source of finance for this expansion programme?

A UK based company is considering investing GBP1 ,000,000 in a project it the USA. It is anticipated that the project will yield net cash inflows of USD580.000 each year for the next three years. These surplus cash flows will be remitted to the UK at the end of each year.

Currently GBP1.00 is worth USD1.30.

The expected inflation rates in the two countries over the next four years are 2% in the UK and 4% in the USA.

Applying the purchasing power parity theory, which of the following represents the expected remittance at the end of year three, in GBP whole the nearest whole GBP)?

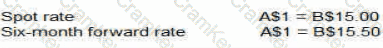

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

Which THREE of the following statements are disadvantages of the net asset basis of valuation?