| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | eisa |

A company is based in Country Y whose functional currency is Y$. It has an investment in Country Z whose functional currency is Z$.

This year the company expects to generate Z$ 10 million profit after tax.

Tax Regime:

• Corporate income tax rate in country Y is 50%

• Corporate income tax rate in country Z is 20%

• Full double tax relief is available

Assume an exchange rate of Y$ 1 = Z$ 5.

What is the expected profit after tax in Y$ if the Z$ profit is remitted to Country Y?

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

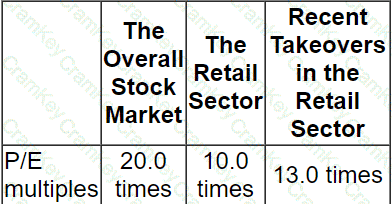

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?

G purchased a put option that grants the right to cap the interest on a loan at 10.0%. Simultaneously, G sold a call option that grants the holder the benefits of any decrease if interest rates fall below 8.5%.

Which THREE possible explanations would be consistent with G's behavior?

A company is currently all-equity financed with a cost of equity of 9%.

It plans to raise debt with a pre-tax cost of 3% in order to buy back equity shares.

After the buy-back, the debt-to-equity ratio at market values will be 1 to 2.

The corporate income tax rate is 25%.

Which of the following represents the company's cost of equity after the buy-back according to Modigliani and Miller's Theory of Capital Structure with taxes?