| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | kyla |

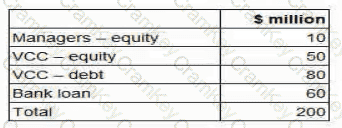

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

ZZZ is a listed company based in Brinland. a European country. It is the largest owner and operator of residential care homes for elderly people in Brinland

Most of the residential care homes in Brinland are run by small private operators, and the standards of cafe are extremely variable However. 22Z has developed a good reputation because its client service is considered to be extremely good even though its prices are higher than those of most of its competitors.

ZZZ has expanded rapidly in the last few years, partly by acquisition and partly by organic growth consequently, the company's share price now stands at a record high, and the dividend declared at the end of the most recent accounting period was 10% higher than the previous year's dividend.

The Brinland government has recently set up a regulatory body to monitor the residential care homes industry. The regulatory body is considering introducing a variety of regulations to improve the customer experience in the industry. Following a period of consultation and investigation, the regulatory body is expected to announce a range of new regulations in the near future.

The directors of ZZZ are concerned that the new regulations may adversely affect their company

Which THREE of the following new regulations are likely to have the greatest negative impact on ZZTs performance?

The Board of Directors of a listed company is considering the company's dividend/retentions policy.

The inflation rate in the economy is currently high and is expected to remain so for the foreseeable future.

The board are unsure what impact the high level of inflation might have on the dividend policy.

Which THREE of the following statements are true?

A young, capital intensive company has a large amount of tangible assets.

Intangibles, including brand name, are considered to be of negligible value at this time

Relevant data:

• The company operates a residual dividend policy.

• The industry in which the company operates is suffering from a large amount of uncertainty at present. Forecasting the future earnings or cashflows of the company is therefore extremely difficult

• There are very few quoted companies in the industry that are similar in size or in precisely the same business sectors.

Which method of valuation would be most suitable for this company?