| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | wiktoria |

An unlisted company is attempting to value its equity using the dividend valuation model.

Relevant information is as follows:

• A dividend of $500,000 has just been paid.

• Dividend growth of 8% is expected for the foreseeable future.

• Earnings growth of 6% is expected for the foreseeable future.

• The cost of equity of a proxy listed company is 15%.

• The risk premium required due to the company being unlisted is 3%.

The calculation that has been performed is as follows:

Equity value = $540,000 / (0.18 - 0.08) = $5,400,000

What is the fault with the calculation that has been performed?

A company generates and distributes electricity and gas to households and businesses.

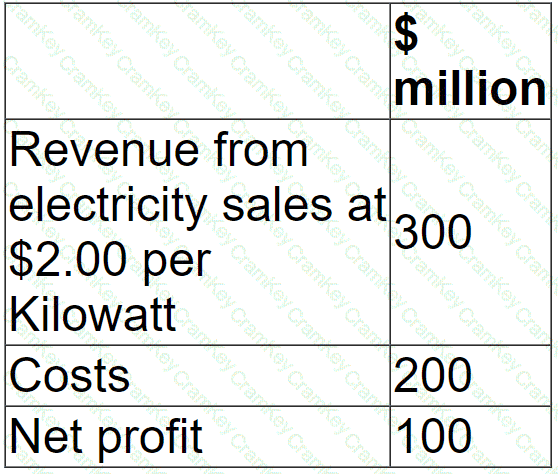

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $1.50 per Kilowatt.

The company expects this to cause consumption to rise by 10% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

If a company's bonds are currently yielding 8% in the marketplace, why would the entity's cost of debt be lower than this?

Company A is identical in all operating and risk characteristics to Company B, but their capital structures differ.

Company B is all-equity financed. Its cost of equity is 17%.

Company A has a gearing ratio (debt:equity) of 1:2. Its pre-tax cost of debt is 7%.

Company A and Company B both pay corporate income tax at 30%.

What is the cost of equity for Company A?