| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | olaf |

Company M's current profit before interest and taxation is $5.0 million.

It has a long-term 10% corporate bond in issue with a nominal value of $10 million.

The rate of corporate tax is 25%.

It plans to continue to pay out 50% of its earnings in dividends and earnings are expected to grow by 3% each year in perpetuity.

Its cost of equity is 10%.

Using the dividend growth model, advise the Board of Directors of Company M which of the following provide a reasonable valuation of Company M's equity?

A company has convertible bonds in issue.

The following debt is apply (31 December 20X0):

• Conversion ratio- 20 shares for each $130 bond.

• Current share price - $4 50

• Expected annual growth in share price - 5%

Advise the bond Holder at which date the convers on would be worthwhile?

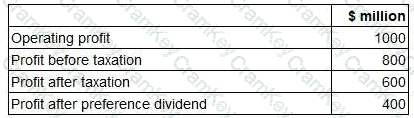

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

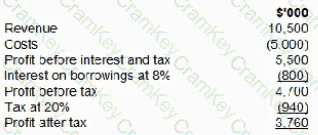

A company is considering taking out $10.000,000 of floating rate bank borrowings to finance a new project. The current rate available to the company on floating rate barrowings is 8%. The borrowings contain a covenant based on an interested cover of 5 times.

The project is expected to generate the following results:

At what interest rate on the floating rate borrowings is the bank covenant first breached?