| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | yaqub |

PYP is a listed courier company. It is looking to raise new finance to fit each of its delivery vans with new equipment to allow improved parcel tracking for customers The senior management team of PYP have decided on a 10-year secured bond to finance this investment-

Which TWO of the following variables are most likely to decrease the yield to maturity of the bond?

A listed company is planning a share repurchase.

The following data applies:

• There are 10 million shares in issue

• The share repurchase will involve buying back 20% of the shares at a price of $0.75

• The company is holding $2 million cash

• Earnings for the current year ended are $2 million

The Directors are concerned about the impact that this repurchase programme will have on the company's cash balance and current year earnings per share (EPS) ratio.

Advise the directors which of the following statements is correct?

A company intends to sell one of its business units, Company R by a management buyout (MBO).

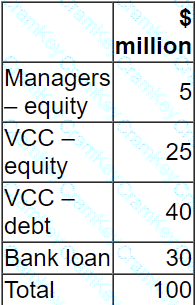

A selling price of $100 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal:

The VCC requires a minimum return on its equity investment in the MBO of 30% a year on a compound basis over 5 years.

What is the minimum TOTAL equity value of Company R in 5 years time in order to meet the VCC's required return?

Give your answer to one decimal place.

$ ? million

A company is concerned about the interest rate that it will be required to pay on a planned bond issue.

It is considering issuing bonds with warrants attached.

Advise the directors which of the following statements about warrants is NOT correct?