| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | damien |

Which of the following statements is true of a spin-off (or demerger)?

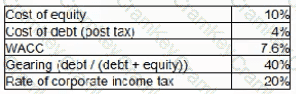

AA is considering changing its capital structure. The following information is currently relevant to AA:

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA’s change in capital structure are true under Modigliani and Miler’s capital structure theory with tax.

A company is funded by:

• $40 million of debt (market value)

• $60 million of equity (market value)

The company plans to:

• Issue a bond and use the funds raised to buy back shares at their current market value.

• Structure the deal so that the market value of debt becomes equal to the market value of equity.

According to Modigliani and Miller's theory with tax and assuming a corporate income tax rate of 20%, this plan would:

A company with 4 million shares in issue wishes to raise $4 million by means of a rights issue

The share price prior to the rights issue is $5.00.

Under the rights issue, 1 million new shares will be issued at $4.00.

When the rights issue is announced it is expected that the Theoretical Ex-rights Price (TERP) will be $4.80

The directors of the company are considering offering any shareholder who does not wish to take up the rights the opportunity to sell the rights back to the company for $1.00.

Which of the following is the most likely consequence of the directors offer?