| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | celeste |

A product costs USD10 when purchased in the USA. The same product costs USD12 when it is purchased in the UK and the price in GBP is convened to USD.

Which of the following statement concerning purchasing power parity is correct?

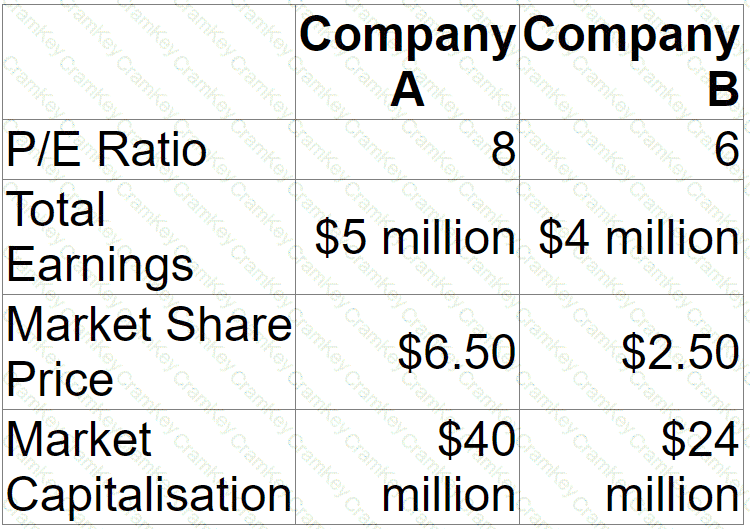

Company A is planning to acquire Company B.

Company A's managers think they can improve the performance of Company B to the extent that its own P/E ratio should be applied to Company B's earnings.

Relevant Data:

What is the expected synergy if the acquisition goes ahead?

Give your answer to the nearest $ million.

$ ? million

On 1 January 20X1, a company had:

• Cost of equity of 10 0%.

• Cost of debt of 5.0%

• Debt of $100Mmilion

• 100 million $1 shares trading at $4.00 each.

On 1 February 20X1:

• The company's share police fell to $3.00.

• Debt and the cost of debt remained unchanged

The company does not pay tax.

Under Modigliani and Miller's theory without lax. what is the best estimate of the movement in the cost of equity as a result of the fall in ne share price?

A company has 6 million shares in issue. Each share has a market value of $4.00.

$9 million is to be raised using a rights issue.

Two directors disagree on the discount to be offered when the new shares are issued.

• Director A proposes a discount of 25%

• Director B proposes a discount of 30%

Which THREE of the following statements are most likely to be correct?