| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | iga |

Company BBB has prepared a valuation of a competitor company, Company BBD. Company BBB is intending to acquire a controlling interest in the equity of Company BBD and therefore wants to value only the equity of Company BBD.

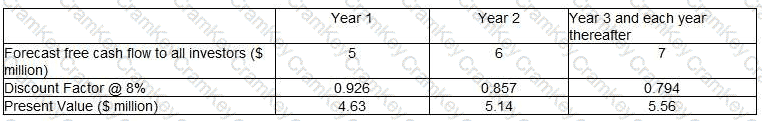

The directors of Company BBB have prepared the following valuation of Company BBD:

Value of Equity = 4.63 + 5.14 + 5.56 = S15.33 million

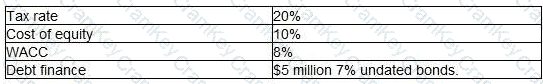

Additional information on Company BBD:

Which THREE of the following are weaknesses of the above valuation?

A company is planning a share buyback. In which of the following circumstances would a share buyback be appropriate?

XYZ is a multi-national group with subsidiary AA in Country A and subsidiary BB in Country B. The capital structures of AA and BB are set up to take advantage of the lower tax rate in Country A Thin capitalisation rules in Country B will limit the ability for either AA or BB to claim tax relief on:

Company J plans to acquire Company K, an unlisted company whose equity is to be valued using a P/E ratio approach.

A listed company has been identified which is very similar to Company K and which can be used as a proxy.

However, the growth prospects of Company K are higher than those of the proxy.

The Directors of Company J are aware that certain adjustments will be necessary to the proxy company's P/E ratio in order to obtain a more reliable valuation.

The following adjustments have been agreed:

• 20% due to Company K being unlisted.

• 15% to allow for the growth rate difference.

The total adjustment to the proxy p/e ratio is: