| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | macy |

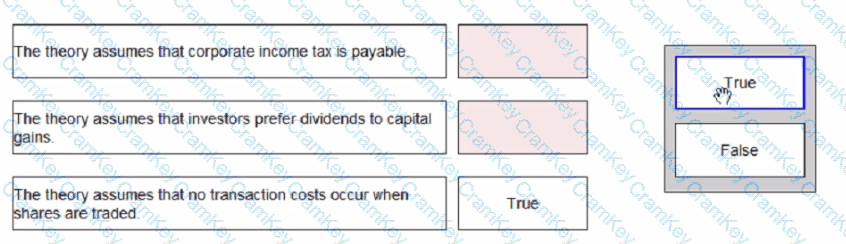

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.

A company based in Country D, whose currency is the D$, has an objective of maintaining an operating profit margin of at least 10% each year.

Relevant data:

• The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

• All purchases are from Country G whose currency is the G$.

• The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?