| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 393 Q&A's | Shared By: | ariya |

Companies L. M N and O:

• are based in a country that uses the RS as its currency

• have an objective to grow operating profit year on year

• have the same total levels of revenue and cost

• trade with companies or individuals in the United States. All import and export trade with companies or individuals in the United States is priced in US$.

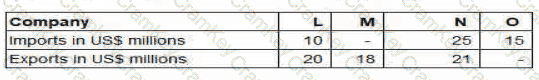

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the USS / RS exchange rate?

A manufacturing company is based in Country L whose currency is the L$.

One of the company's products is exported to Country M, a rapidly growing economy, whose currency is the M$.

In the most recent financial year:

• 100,000 units of the product were sold to customers in country M

• The unit selling price was M$12

The spot rate today is L$1 = M$5

The company has an objective of growth in total sales value in L$ of 10% a year.

If the L$ strengthens by 5% next year against the M$, what volume of sales of this product is needed next year to achieve the objective?

Which of the following statements are true with regard to interest rate swaps?

Select ALL that apply.

Company H is considering the valuation of an unlisted company which it hopes to acquire.

It has obtained the target company's financial statements.

Company H has been advised that the book value of net assets as shown in the financial statements of the target company does not provide a reliable indicator of their true value.

Advise the Board of Directors which of the following THREE statements are disadvantages of the net asset basis of valuation?