| Exam Name: | Financial Strategy | ||

| Exam Code: | F3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Strategic |

| Questions: | 435 Q&A's | Shared By: | king |

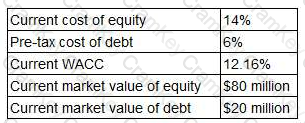

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?

Which THREE of the following are the most likely exit routes that apply to a venture capitalist?

Company AAB is located in country A whose currency is the AS It has a subsidiary, BBA, located m country B that has the BS as its currency AAB has asked BBA to pay BS40 million surplus funds to AAB to assist with a planned new capital investment in country A The exchange rate today is AS1 = BS3

Tax regimes

• Company BBA pays withholding tax of 25% on all cash remitted to the parent company

• Company AAB pays tax of 10% on at cash received from its subsidiary

How much will company AAB have available for investment after receiving the surplus funds from BBA?