Financial Strategy

Last Update Jan 31, 2026

Total Questions : 393

To help you prepare for the F3 CIMA exam, we are offering free F3 CIMA exam questions. All you need to do is sign up, provide your details, and prepare with the free F3 practice questions. Once you have done that, you will have access to the entire pool of Financial Strategy F3 test questions which will help you better prepare for the exam. Additionally, you can also find a range of Financial Strategy resources online to help you better understand the topics covered on the exam, such as Financial Strategy F3 video tutorials, blogs, study guides, and more. Additionally, you can also practice with realistic CIMA F3 exam simulations and get feedback on your progress. Finally, you can also share your progress with friends and family and get encouragement and support from them.

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?

A company based in Country D, whose currency is the D$, has an objective of maintaining an operating profit margin of at least 10% each year.

Relevant data:

• The company makes sales to Country E whose currency is the E$. It also makes sales to Country F whose currency is the F$.

• All purchases are from Country G whose currency is the G$.

• The settlement of all transactions is in the currency of the customer or supplier.

Which of the following changes would be most likely to help the company achieve its objective?

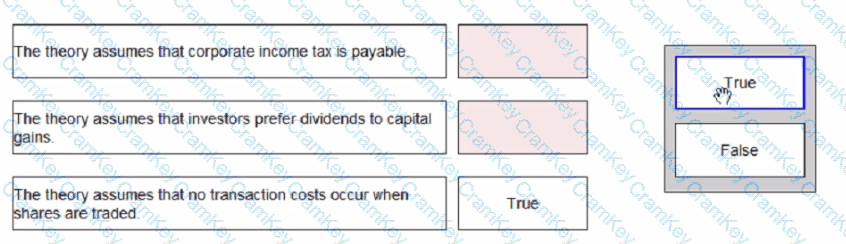

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.