| Exam Name: | Financial Risk and Regulation (FRR) Series | ||

| Exam Code: | 2016-FRR Dumps | ||

| Vendor: | GARP | Certification: | Financial Risk and Regulation |

| Questions: | 387 Q&A's | Shared By: | ayoub |

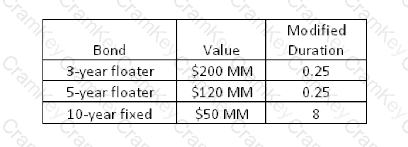

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?

In hedging transactions, derivatives typically have the following advantages over cash instruments:

I. Lower credit risk

II. Lower funding requirements

III. Lower dealing costs

IV. Lower capital charges

Bank Milo has $4 million in cash and $5 million in loans coming due tomorrow with an expected default rate of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On what days does the bank face negative cumulative liquidity?