| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | abubakr |

Select THREE actions that should be taken by a business offering credit to its customers to ensure that amounts owing are collected as quickly as possible.

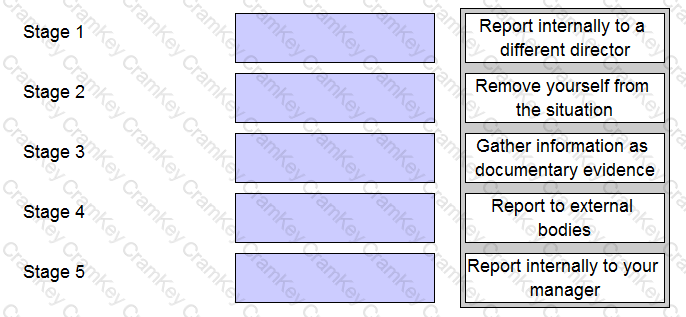

You work in the finance department of an entity. A director has approached you and asked you to falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

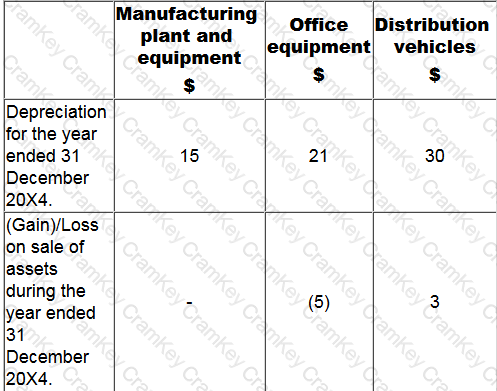

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

In most developed countries employers deduct the tax from employees' pay each month and then pay the tax to the tax authorities on behalf of the employee on a monthly basis.

Which THREE of the following are advantages of this system to the employee?