| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | gigi |

KL has just completed their inventory count and has ascertained that the cost value of the inventory is $460,000; this was made up of 10,000 units of component part FF.

A week before the year end the FF components were moved to a temporary warehouse.

Two weeks later they were inspected and found to have been damaged by the damp conditions in the temporary warehouse.

Of the 10,000 units 2,500 of them were damaged. After remedial work of $5.00 per unit KL anticipates they will be able to sell the damaged parts for $32.00 per unit.

What is the value for closing inventory to be included in the financial statements of KL?

Give your answer to the nearest $.

An entity purchased an asset on 1 April 20X4 for $320,000, exclusive of import duties of $32,000.

The entity sold the asset on 31 March 20X9 for $480,000 incurring legal fees of $12,000.

The entity is resident in Country Y where chargeable capital gains are taxed at 20% and no indexation is allowed.

Calculate the amount of capital tax that the entity is due to pay.

Give your answer to the nearest whole $.

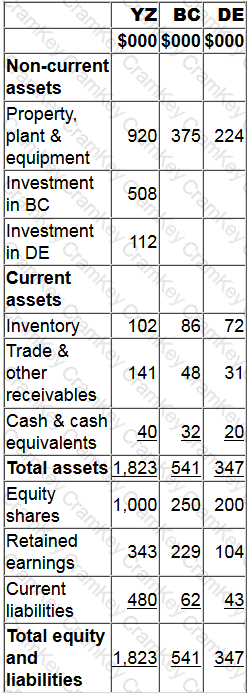

Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC's equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC's retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE's equity shares on 1 April 20X1 for $112,000. DE's retained earnings at 1 April 20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC's inventory at 31 March 20X2.

Calculate the goodwill arising on the acquisition of BC.

Give your answer to the nearest whole $.

Which of the following is the most appropriate definition of the term 'factoring'?