| Exam Name: | Financial Reporting | ||

| Exam Code: | F1 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Operational |

| Questions: | 248 Q&A's | Shared By: | blake |

In 20X4, DEF closed its business having made a trading loss of $160,000. In DEF's country of residence, trading losses may be carried back three years on a LIFO basis.

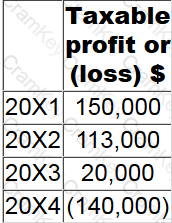

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

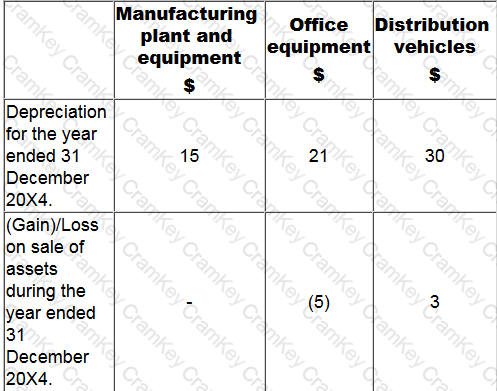

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31 December 20X4 in relation to Interest and Corporate income tax?

Which of the following is NOT a primary need for regulating financial reporting information of incorporated entities?

Which of the following would be classified as a parent and subsidiary relationship in accordance with IFRS 10 Consolidated Financial Statements?