| Exam Name: | Fundamentals of management accounting | ||

| Exam Code: | BA2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Certificate |

| Questions: | 392 Q&A's | Shared By: | miller |

In investment appraisal, the internal rate of return is

The decision rule to use when determining the optimal production plan if there is a scarce resource is:

CVP Limited manufactures a single product with a selling price of $25.60. Fixed costs are $122,880 per month and the product has a profit/volume ratio of 40%.

In a month when actual sales were $358,400, CVP's margin of safety in units was

Refer to the Exhibit.

Fabex Ltd manufactures a household detergent called "Clear". The standard data for one of the chemicals used in production (chemical XTC) is as follows:

(a) 50 litres used per 100 litres of 'Clear' produced

(b) Budgeted monthly production is 1000 litres of 'Clear'.

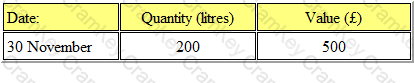

The closing inventory of chemical XTC for November valued at standard price was as follows:

Actual results for the period during December were as follows:

(a) 500 litres of chemical XTC was purchased for £1300.

(b) 550 litres of chemical XTC was used.

(c) 900 litres of 'Clear' was produced.

It is company policy to extract the material price variance at the time of purchase.

What is the total direct material price variance (to the nearest whole number)?