| Exam Name: | Fundamentals of financial accounting | ||

| Exam Code: | BA3 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Certificate |

| Questions: | 393 Q&A's | Shared By: | jennifer |

Which of the following best explains what is meant by "capital expenditure"?

On 1 January 2001, a company owed a supplier £840.

During the month of January the company purchased goods for £1400 and returned goods valued at £200. A payment of £200 was made towards the outstanding balance. The supplier offered a discount of 5% on purchases.

The balance on the supplier's account at the end of the period is:

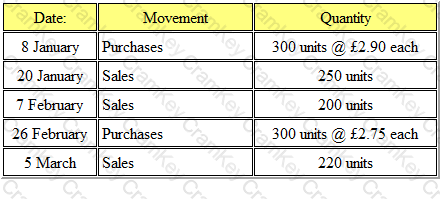

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. Opening inventory at the beginning of the period was 200 units @ £2.80 each. During the period the following movements of inventory were recorded.

The value of the closing inventory at the end of the period and amount charged to the income statement were:

The trial balance shows the debit total as $200 less than the credit total.

This could be due to: