| Exam Name: | Certified Cost Professional (CCP) Exam | ||

| Exam Code: | CCP Dumps | ||

| Vendor: | AACE International | Certification: | AACE Certification |

| Questions: | 189 Q&A's | Shared By: | lyla-rose |

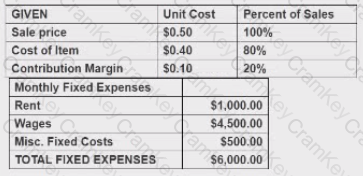

As the leas cost engineer for the XYZ Services Company, you have been requested to provide pertinent for an equipment rental decision. The unit price of the food stuffs varies, but an average unit selling process has been determined to be $0.50 cents and the average unit acquisition cost is $0.40 cents.

The following revenue and expense relationships are predicted:

If the fixed rent remains unchanged, and XYZ pays S0.01 per unit as additional rent, the monthly breakeven point in numbers of units becomes:

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

How much money should be set aside today to have $20,000 available eight (8) years from now if the interest rate is 6% compounded annually?

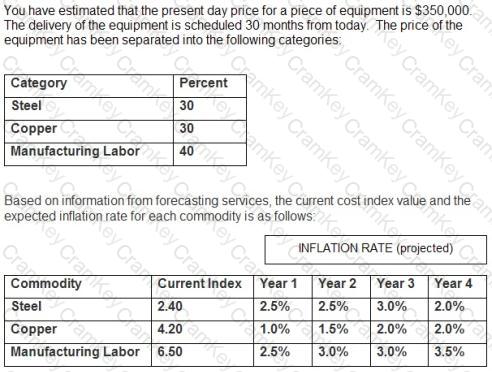

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Calculate the mean unit cost.

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and nosalvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which numerical method of describing quantitative data is best suited in targeted marketing?