| Exam Name: | Certified Cost Professional (CCP) Exam | ||

| Exam Code: | CCP Dumps | ||

| Vendor: | AACE International | Certification: | AACE Certification |

| Questions: | 189 Q&A's | Shared By: | sierra |

Which of the following is NOT an aspect of quality management?

After collecting the control information on a light rail project within an original budget of 200.000 work hours, the construction contractor is ready for their monthly progress meeting with the client.

A total of 100.000 work hours have boon scheduled to date. with 105.000 work hours earned, and 110.000 work hours paid. The stated progress by the contractor Is 60%.

What is the cost variance (CV)?

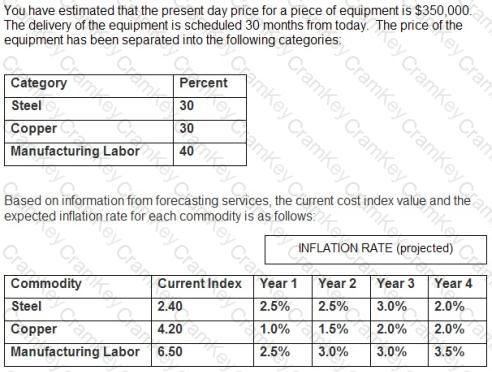

The following question requires your selection of CCC/CCE Scenario 4 (2.7.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the cost index value of copper at the end of Year 2? (rounded to 2 decimal positions)

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

The taxable income in year number 5 is: