Risk Management

Last Update Mar 10, 2026

Total Questions : 339

To help you prepare for the P3 CIMA exam, we are offering free P3 CIMA exam questions. All you need to do is sign up, provide your details, and prepare with the free P3 practice questions. Once you have done that, you will have access to the entire pool of Risk Management P3 test questions which will help you better prepare for the exam. Additionally, you can also find a range of Risk Management resources online to help you better understand the topics covered on the exam, such as Risk Management P3 video tutorials, blogs, study guides, and more. Additionally, you can also practice with realistic CIMA P3 exam simulations and get feedback on your progress. Finally, you can also share your progress with friends and family and get encouragement and support from them.

C Ltd is a private, family-owned company which is hoping to become listed on a recognised Stock Exchange within the next two years. At the moment, the Board of Directors comprises five directors; four of whom are from the founding family and all of whom are involved in the day-to-day running of the business. The remaining director obtained a seat on the Board three years ago as a condition of an investment by a venture capital fund.

The Board meets in half-day sessions once a fortnight and the Board meetings are reasonably well run. All decisions are taken by the Board as a whole. There are no sub-committees.

Which of the following steps would it be appropriate for C Ltd to take in the light of the proposed listing?

The management of U is reviewing internal controls throughout the company. It has noted the following:-

1. In the trade receivables section, journal adjustments are made by the clerks, without any reference to their supervisor. Journal adjustments may relate to sales returns, discounts allowed, or transfers between accounts.

2. In the purchasing department, the purchasing manager selects and approves all suppliers, as they are the only person with sufficient experience to do so. They use a very limited number of suppliers because they can rely on these suppliers to provide goods of the quality required at a competitive price. They do not keep any documents in relation to negotiations with other potential suppliers or other quotes obtained.

In relation to the above, which of the following statements are valid?

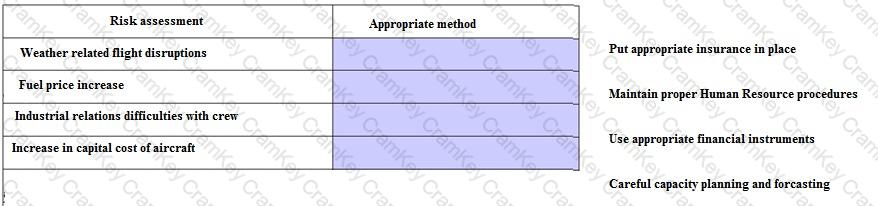

As part of risk assessment exercise for a low-cost airline you are requested to match the risks listed below with the most approriate method of minimising or dealing with each risk.

The managers of a company are agents for the shareholders tasked with increasing shareholders' wealth. Which of the following will usually increase shareholders' wealth?