| Exam Name: | F2 Advanced Financial Reporting | ||

| Exam Code: | F2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Management |

| Questions: | 268 Q&A's | Shared By: | bobbi |

Which TWO of the following are TRUE in respect of preparing a consolidated statement of cash flows where there has been an acquisition of a subsidiary part way through the year?

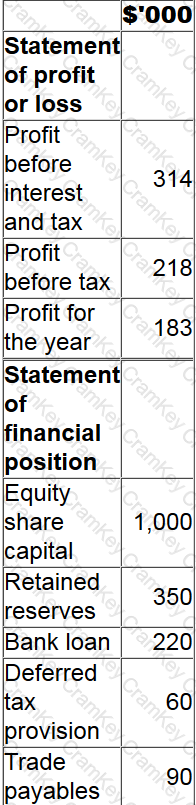

The following information is extracted from the financial statements of RS for the year ended 30 June 20X7:

RS has no other liability balances and has no associate investments.

Calculate return on capital employed for RS at 30 June 20X7.

Give your answer to the nearest whole %.

? %

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

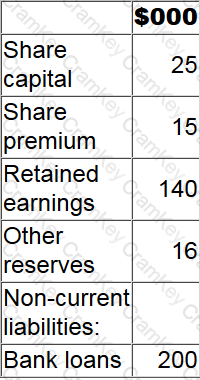

MN had the following profit figures for the year ended 30 November 20X6:

MN's statement of financial position at 30 November 20X6 included the following:

Calculate return on capital employed for MN for the year ended 30 November 20X6.

Give your answer to one decimal place.

? %