| Exam Name: | F2 Advanced Financial Reporting | ||

| Exam Code: | F2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Management |

| Questions: | 268 Q&A's | Shared By: | arnie |

LM has made the following share purchases during the year:

• Purchased 55% of the equity share capital of OP.

• Purchased 45% of the equity share capital of QR. LM have the power to appoint the majority of board members on the QR board.

• Purchased 30% of the equity share capital of ST. LM is represented by one director on the main board of ST which has five members in total. The other 70% of ST's equity share capital is owned by a single company, UV.

The Managing Director has told you that OP has performed well, but both QR and ST have not performed as expected. He is therefore pleased that OP will be included as a subsidiary and that QR and ST will only be included as investments in the group financial statements.

In accordance with the ethical principle of professional competence and due care how should the investments in OP, QR and ST be treated in the group financial statements?

ST acquired two financial investments in the year to 31 December 20X8. One of these investments was initially classified as held for trading, the other as available for sale. ST remeasured both investments at fair value at 31 December 20X8 in accordance with IAS 39 Financial Instruments: Recognition and Measurement. The resulting gains were calculated as follows:

• Gain on held for trading investment $50,000

• Gain on available for sale investment $40,000

What was the value of the gain that ST presented in its other comprehensive income when it prepared its financial statements for the year to 31 December 20X8?

Give your answer to the nearest $000.

$ ? 000

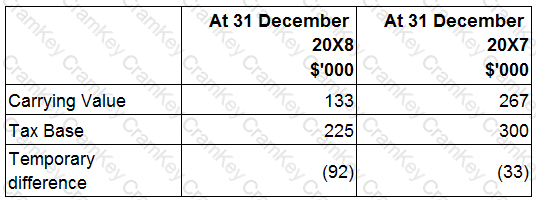

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

Which of the following principles are the basic principles followed by the consolidated income statement?

Select ALL that apply.