| Exam Name: | F2 Advanced Financial Reporting | ||

| Exam Code: | F2 Dumps | ||

| Vendor: | CIMA | Certification: | CIMA Management |

| Questions: | 268 Q&A's | Shared By: | allegra |

AB acquired 90% of the equity of YZ on 31 December 20X2. On the same date YZ acquired 60% of the equity shares of VW for $750,000. AB has no other subsidiaries.

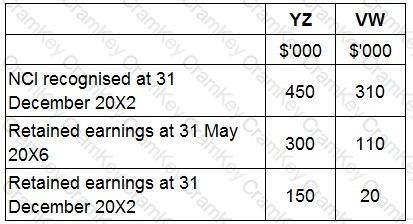

The following information regarding YZ and VW was available:

What amount will AB include in its consolidated statement of financial position in respect of non controlling interest at 31 May 20X6?

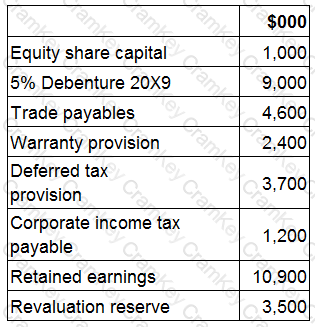

Information extracted from JK's statement of financial position for the year ended 31 May 20X5 is as follows:

Calculate the gearing ratio (Debt/Equity measured as a percentage) at 31 May 20X5.

Give your answer to one decimal place.

? %

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

AB and FG incorporated on 1 January 20X1 in the same country and had similar investment in net assets. Both entities are financed entirely by equity. In the year to 31 December 20X1 both entities generated the same volume of sales.

Which of the following, taken individually, would explain why AB's return on capital employed ratio was lower than that of FG?