| Exam Name: | Canadian Investment Funds Course Exam | ||

| Exam Code: | CIFC Dumps | ||

| Vendor: | IFSE Institute | Certification: | Investments & Banking |

| Questions: | 224 Q&A's | Shared By: | duaa |

In which of the following situations would the client mobility exemption apply?

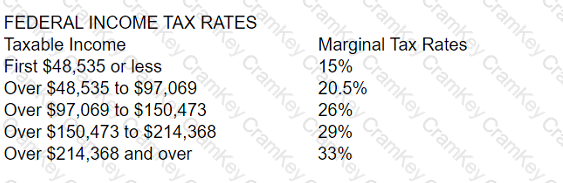

Kerry's total income this past year was $100,000 and she claimed a tax deduction of $2,000. When the tax return is filed, what would be the federal tax payable when applying the following federal tax rates?

(Round to the closest whole dollar for the final answer.)

Eleanora receives a $500 eligible Canadian dividend from her mutual fund. Her federal marginal tax rate for the year is 29%. Assuming the enhanced gross-up of 38% and a federal dividend tax credit of 15.02%, how much federal tax will she pay on her dividend?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?