| Exam Name: | Canadian Investment Funds Course Exam | ||

| Exam Code: | CIFC Dumps | ||

| Vendor: | IFSE Institute | Certification: | Investments & Banking |

| Questions: | 224 Q&A's | Shared By: | sid |

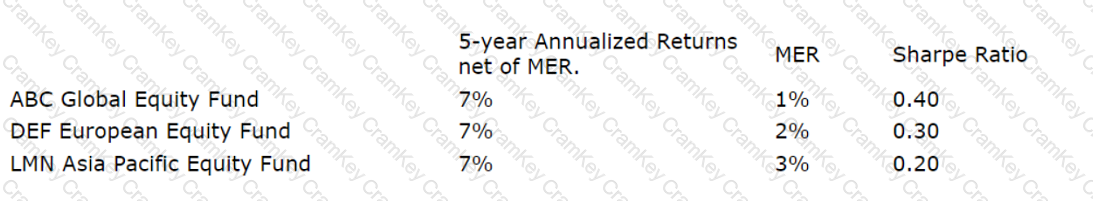

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

Throughout the year, the Redwood Global Equity Fund generated the following outcomes:

. $1.00 per unit of interest income from Canadian treasury bills

. $2.50 per unit of dividend income from foreign corporations

. $7.75 per unit of capital gains from the sale of Canadian corporations

. $6.50 per unit of capital gains from the sale of foreign corporations

. $2.00 per unit of capital losses from the sale of foreign corporations

Given that the Redwood Global Equity Fund is structured as a mutual fund trust, which of the following statements is true?

Yesterday, Mariana who is new to investing and purchased mutual funds for the very first time. She shared her excitement with her good friend, Julius. However, after Julius learned about her investment, he

admits that he had a bad experience with mutual fund investing and that he lost money. Mariana regrets not talking to Julius prior to making her decision. Her feelings of enthusiasm have changed to fear. She

is wondering if it is too late to change her mind and cancel her purchase order.

Which statement regarding the right of withdrawal is CORRECT?