| Exam Name: | Certified Treasury Professional | ||

| Exam Code: | CTP Dumps | ||

| Vendor: | AFP | Certification: | AFP Certification |

| Questions: | 1076 Q&A's | Shared By: | byron |

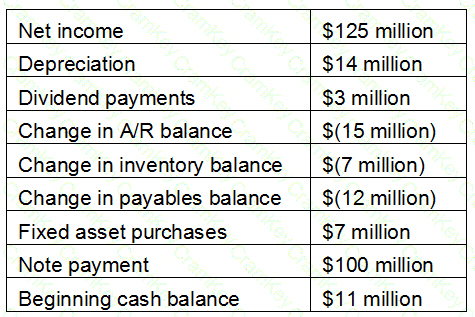

The treasury analyst at RST Corporation has been asked to forecast cash levels for the company’s year-end balance sheet. The analyst has been given the following information:

What should the analyst project as the upcoming year-end cash balance?

ABC Company offers a discount of 2/10, net 30 to its customers. ABC factored its accounts receivables with an outside vendor, under a “with recourse” arrangement. What impact might this have on the company?

A company’s Chief Financial Officer assigns a team reporting to the Treasurer to restructure the company’s complex debt instruments and equipment leasing arrangements. The team executes the required settlement transactions using wire payments to facilitate the new debt structure, and in the process violates the lending requirements of the company’s bank. What should the Treasurer have done to prevent the violation?

The Treasury Analyst at an investment firm has entered the company into a repurchase agreement with a counterparty at the direction of the Treasury Manager. The compliance office has determined that the trade was done in violation of the company investment policy. The Treasury Manager has the power to approve the execution of trades; however, the Treasury Analyst was not a designated trader on behalf of the firm. Which area of the investment policy was violated by the Treasury Analyst?