| Exam Name: | Certified Treasury Professional | ||

| Exam Code: | CTP Dumps | ||

| Vendor: | AFP | Certification: | AFP Certification |

| Questions: | 1076 Q&A's | Shared By: | ezra |

Management is concerned with the level of volatility in the company's fixed income portfolio. Which of the following measures will provide management with the MOST comprehensive view of portfolio volatility?

A large mature, diversified. publicly traded company sells the smallest of its business segments to a strategic buyer for cash. It uses the proceeds to pay off all bank debt and subordinated debenture debt on its books. The company believes the stock is trading at a reasonable price and continues to pay a regular steady dividend to shareholders. Management's strategy is to embark on an aggressive growth plan including a major acquisition.

Based on the above information before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

A manufacturing company's long-term capital structure is 30% debt and 70% equity, its cost of equity is 10%, its average cost of debt is 8%, and the marginal tax rate is 34%. If the company has invested total capital of $567,865 in its production unit and the unit's operating profit is $79,856, what is the economic value added (EVA) of the unit?

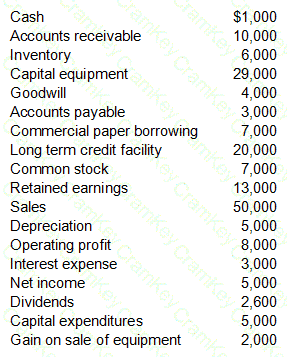

BF Company, a manufacturer of food products, reported financial information shown in the table below for the end of the year.

BF Company is subject to covenants under its revolving credit facility. It is in compliance with which of the following?