| Exam Name: | Certified Treasury Professional | ||

| Exam Code: | CTP Dumps | ||

| Vendor: | AFP | Certification: | AFP Certification |

| Questions: | 1076 Q&A's | Shared By: | arabella-rose |

A treasurer decides to use notional pooling across wholly-owned multiple legal entities instead of wiring money between entity accounts. What specific section in the company’s policy allowed the treasurer to make this decision?

A North American service company has autonomous offices in different geographic regions each handling their own sales and accounts receivables deposits to local banks which primarily consist of checks. By implementing a lockbox collection system, what objective in its collection policy would it have met?

What should a company’s senior management consider in their payment policies to eliminate the co-mingling of funds for payables, receivables and foreign exchange transactions?

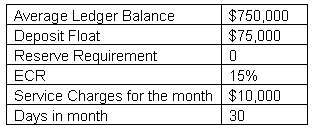

ABL Corporation is currently receiving a return of 10% on its investments. The bank is offering them an ECR of 15%. In order to get more value for their money ABL Corp. has decided to take advantage of the higher ECR and use funds from its Money Market Accounts to cover bank service charges.

If ABL already has an average ledger balance of $750,000, how much more do they need to deposit on their account to cover all $10,000 of monthly service charges?