| Exam Name: | Managerial Accounting (SAYA-0009) Exam | ||

| Exam Code: | BUS105 Dumps | ||

| Vendor: | Saylor | Certification: | Saylor Direct Credit Courses |

| Questions: | 50 Q&A's | Shared By: | andrew |

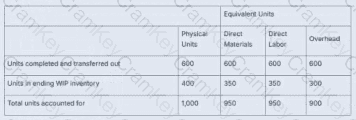

Use the following relevant data to assign costs to units transferred out and units in ending WIP inventory. Total Units Accounted For:

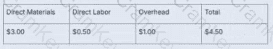

Cost per Equivalent Unit:

What is the total cost of production?

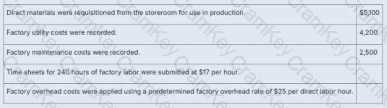

What is the balance in the manufacturing overhead account after these transactions were recorded, assuming the beginning balance was zero?

Now calculate the balance:

Manufacturing Overhead Balance = Actual Overhead – Applied Overhead

= $6,700 – $6,000 = $700 underapplied

Underapplied overhead → debit balance in Manufacturing Overhead account

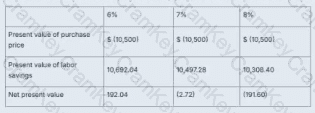

The manager of Ladron Candies is deciding whether or not to invest in new equipment with a purchase price of $10,500 and a required rate of return of 7%. Given this calculation of the present value of cash inflows and outflows for the next three years, what should he decide, based on the internal rate of return?

Thompson Dental is deciding between two lease options for a new copier. They anticipate making 22,500 copies spread evenly over the course of the year. Which of the following options should they choose if they want to save the most money on an annual basis, and how much money will they save?

Option 1: Monthly lease: $225, Included copies: 1,500/month, Additional copies: $0.15 per copy

Option 2: Monthly lease: $250, Included copies: 1,800/month, Additional copies: $0.02 per copy